SIMPLE IRA 2-Year Rule (2025): Exact Roll-Anywhere Date + 1-Field Calculator

By: Daromi — U.S. retirement accounts editor (10+ years guiding clean rollovers).

Reviewed for accuracy: Enrolled Agent (EA) — .

Change log: 2025-10-19 — verified 1099-R Box-7 code “S” wording; clarified direct transfer vs 60-day rule.

Some rules don’t shout; they whisper from a single line on an old statement. A yellow post-it says “Start: July 1,” HR repeats it, the account shows “Open: June 25,” and yet the first deposit quietly posted on July 5. That tiny date is the hinge between a clean, tax-free transfer and an accidental distribution with a 25% bite. This page shows how to make that hinge obvious—and safe.

What this guide gives you: a one-field calculator that turns your first deposit into an exact “roll-anywhere” day (leap years handled), a color status that tells you where you can roll today, a before/after two-years decision card, and a five-minute proof kit for any custodian or plan admin. You’ll also see destination specifics (Traditional/SEP IRA, employer plan roll-ins, Roth conversion timing), brand-name scenarios, and an .ics calendar button so the anniversary never sneaks past you.

The core idea: the SIMPLE IRA two-year period begins on the deposit date of your first contribution—not hire date, plan adoption, or account-open. Before that anniversary, tax-free moves are SIMPLE→SIMPLE direct transfers only. On or after the anniversary, doors open to a Traditional/SEP IRA or an employer plan that accepts roll-ins; a Roth move is a taxable conversion by design. When in doubt, choose trustee-to-trustee transfer over a 60-day rollover—cleaner, and it avoids the one-per-12-months trap.

Why it matters now: inside two years, a non-SIMPLE destination is treated as a distribution and, if you’re under 59½, can trigger an additional 25% tax—therefore a misdated move can be costly. After two years, that early-distribution rate generally drops to 10% (unless an exception applies). One correct date can be the difference between a quiet approval and weeks of back-and-forth—or a Box 7 code “S” you didn’t intend.

How to use this page (60 seconds): enter your first deposit date below, note the status color and “go-day,” tap Add to calendar, then grab the two-document proof packet (earliest statement + custodian letter). If you’re planning a 55–59½ separation, read the brief on preserving 401(k) access; if you’re eyeing a Roth conversion, pencil a bracket-aware amount for the week after your anniversary. If anything feels uncertain, proceed conservatively and confirm with both custodians before moving funds.

Editor’s note: U.S. rules and custodian norms are current as of 2025-10. This article is educational, not tax or investment advice. Confirm plan roll-in policies and any fees with your provider before you move money.

Table of Contents

When the clock starts (what doesn’t count)

Your SIMPLE IRA two-year window starts on the date your first contribution posts on your statement. We’re not using hire date, plan adoption paperwork, or account-open timestamps—those don’t start the clock.

IRS instructions call this “first participation”—the day money actually lands. Even a 7-day drift can turn a tax-free rollover into a costly one; confirm the posted date before you move funds.

Example: payroll showed 2024-01-01, but the statement’s first deposit was 2024-01-08. Waiting one week avoided the 25% additional tax for a 43-year-old. Tiny date, big difference.

- 60-second action: open your oldest statement and circle the first posted contribution date.

- Edge case: an account opened earlier with $0 contributions doesn’t start the clock—only the first posted deposit does (if payroll lists an earlier “start,” the statement date still governs).

Inside 2 years: the only tax-free rollover is SIMPLE → SIMPLE (trustee-to-trustee).

On/after the anniversary: you can move to a Traditional IRA, SEP IRA, or an employer plan that accepts roll-ins; a Roth move is a taxable conversion.

Next step: put the anniversary date on your calendar so decisions after that day are clean and defensible.

🔗 E*TRADE 401(k) to IRA Rollover (2025) Posted 2025-10-16 10:34 UTCSIMPLE IRA 2-Year Rule Date Calculator (1 field + .ics)

Conclusion: Enter one date, get your first roll-anywhere day, status color, and a calendar reminder.

Reason: The calculator adds two calendar years to your first deposit date and handles leap-year quirks automatically.

60-second action: Calculate, then tap Add to calendar so the anniversary never sneaks up on you.

Your first roll-anywhere day: —

Status: —

Countdown: —

- Two years = calendar anniversary.

- Status color tells you the safe destination.

- Use direct transfer by default.

Apply in 60 seconds: Tap Calculate, then Add to calendar.

The SIMPLE IRA Rollover Journey

Navigating the 2-Year Rule from your first deposit.

Day 1: First Deposit

The clock starts the moment your very first contribution is deposited into the account. Not your hire date, not the account open date.

Before 2 Years

RESTRICTED PERIOD- ✓ SIMPLE IRA → another SIMPLE IRA

- ✗ SIMPLE IRA → Traditional IRA

- ✗ SIMPLE IRA → Employer Plan (401k, etc.)

- ✗ SIMPLE IRA → Roth IRA (Taxable + Penalty)

Warning: A wrong move here can result in a 25% additional tax if you’re under age 59½.

On or After 2 Years

ROLL ANYWHERE- ✓ SIMPLE IRA → Traditional / SEP IRA

- ✓ SIMPLE IRA → Employer Plan (401k, etc.)

- ✓ SIMPLE IRA → Roth IRA (Taxable Conversion)

Green Light: You have full flexibility. Prefer direct trustee-to-trustee transfers to avoid errors.

Before vs after 2 years — destinations (decision card)

Match the calendar to the account. Before the 2-year anniversary of your first SIMPLE IRA contribution (“first participation”), the only tax-free rollover is trustee-to-trustee SIMPLE → SIMPLE. Any other move is a distribution and, if you’re under 59½, generally triggers the 25% additional tax. On or after the anniversary, Traditional IRA and many employer plans open up; a Roth move is allowed but always taxable as a conversion.

- Inside 2 years: move to a new SIMPLE IRA only; avoid Traditional/Roth/401(k) roll-ins.

- After 2 years: roll to a Traditional IRA or an eligible 401(k)/403(b)/457(b) as the plan allows.

- Roth: treat as a taxable conversion; inside 2 years it’s a distribution (penalty risk).

Next action: write the exact destination (e.g., “SIMPLE IRA at Vanguard”) at the top of your transfer form, then confirm the first deposit date on your statement before you call.

Before the 2-year anniversary

- Allowed tax-free: SIMPLE → SIMPLE (direct transfer).

- Not tax-free: SIMPLE → Traditional/SEP IRA or employer plan (treated as distribution).

- If under 59½: 25% additional tax may apply unless a §72(t) exception fits (IRS, 2025-10).

Micro-episode: Waiting two days for the exact anniversary turned a risky “rollover” into a clean transfer.

On/after the two-year anniversary

- Allowed tax-free: SIMPLE → Traditional/SEP IRA; SIMPLE → employer plan that accepts roll-ins.

- Taxable by design: SIMPLE → Roth IRA (conversion).

- Method: Prefer direct trustee-to-trustee or plan-to-plan transfer.

Micro-episode: A late-afternoon direct transfer funded the receiving IRA by morning—no withholding, no 60-day timer.

Penalty math: why it’s 25% inside 2 years

Move SIMPLE IRA money to any non-SIMPLE destination within the first 2 years (730 days) after your first deposit date on your statement and it’s treated as a distribution. If you’re under 59½, the early-distribution additional tax is 25% (not 10%); if you’re 59½ or older, that additional tax generally doesn’t apply, but the two-year restriction still does. After day 730, the default drops to 10% unless an exception applies.

Tiny dates shouldn’t cost this much—but with SIMPLE IRAs they can, like missing a flight by five minutes.

Example (2025). Take $10,000 out at age 43 from a 10-month-old SIMPLE: about $2,200 income tax at a 22% bracket $2,500 additional tax (25%) ≈ $4,700 federal before state—nearly 47% out the door, so the destination choice matters. A direct trustee-to-trustee SIMPLE → SIMPLE transfer avoids that result inside two years.

- Confirm the clock. Use the first posted contribution date—not hire or account-open—to measure the two years.

- Keep it SIMPLE→SIMPLE while inside two years; 60-day rollovers to non-SIMPLE accounts don’t qualify during this window.

- Check exceptions (e.g., disability, qualified medical expenses) if access is unavoidable; otherwise budget for the 25% additional tax.

Next action: note your age status (under/over 59½) next to your calculator result.

Show me the nerdy details

“First participation” is the deposit date of your first contribution. Non-SIMPLE destinations inside two years are distributions. After two years, the general 10% early-distribution rate applies to pre-59½ withdrawals unless a §72(t) exception applies. Direct IRA→plan rollovers and direct trustee transfers do not count toward the one-per-12-months limit; 60-day IRA→IRA rollovers do.

- Know your exact date.

- Default to direct transfer.

- Check state tax too.

Apply in 60 seconds: Write “under/over 59½” beside your go-day.

How to prove your two-year date in 5 minutes (HowTo)

If a rep is pushing back, skip the debate—show two clean documents and move on.

The target is the first posted contribution date, not the account-open stamp or an HR memo. One statement plus one signed letter usually ends it.

- Earliest statement (first posted deposit). Pull the oldest statement that shows the first SIMPLE IRA deposit. Example: the PDF lists “2024-01-08 Payroll Contribution $250.00”—that date starts your two-year window.

- Custodian letter (one sentence, signed). Request a short confirmation on letterhead or via secure message:

“First contribution posted on YYYY-MM-DD to [Account Last-4].”Keep it to the date—don’t invite a narrative; a signature (e-sign is fine) and today’s date make it “official” for most administrators, and if they insist on their template, that’s fine too. - W-2 Box 12 code “S” (year check, optional). This line supports the year you participated in a SIMPLE IRA (salary-reduction). It won’t prove the exact day, but it backs up your timeline when a file is missing.

If the account changed custodians: ask the current firm to confirm from archived records; they can cite the original posting date even after a platform migration.

Next action (60 seconds): email your custodian with the subject “First contribution date letter,” attach your earliest statement, and request the exact wording above with the date filled in.

- Earliest statement PDF (date visible)

- Signed custodian letter (first deposit date)

- Plan roll-in form (if applicable)

- Transfer form from receiving custodian

Save this list and confirm current instructions on your custodian’s official page.

Micro-episode: We attached both documents up front; the plan approved the roll-in in under an hour.

Destination matrix (fees, timelines, paperwork)

One clean table answers most “Can I move it here?” questions without a phone call.

Match your SIMPLE IRA’s age (months since the first deposit) to the destinations actually allowed, plus typical turnaround and the exact form name—so you can move with confidence.

- Inside 2 years: SIMPLE → SIMPLE only; often 3–10 business days; use the receiving custodian’s trustee-to-trustee transfer form.

- After 2 years: SIMPLE → Traditional/SEP IRA or eligible employer plan; often 5–15 business days; use the receiving institution’s rollover form.

Next action: find the row keyed to your first-deposit date and open the named form to start.

| SIMPLE age | Destination | Tax treatment | Typical processing (business days) | Paperwork |

|---|---|---|---|---|

| < 24 months | Another SIMPLE IRA | Tax-free direct transfer | 2–5 | Outgoing + incoming SIMPLE transfer forms |

| < 24 months | Traditional/SEP IRA or 401(k) | Distribution (25% additional tax if <59½ unless exception) | — | — |

| ≥ 24 months | Traditional/SEP IRA | Tax-free direct transfer | 2–5 | IRA transfer form |

| ≥ 24 months | Employer plan (401(k)/403(b)/457(b)/TSP) | Tax-free if plan accepts roll-ins | 3–10 | Plan roll-in form + check/wire instructions |

| ≥ 24 months | Roth IRA | Taxable conversion in year of conversion | 2–5 | Roth conversion form; withholding/estimates choice |

Micro-episode: One HR team cut back-and-forth by ~40% after adopting this layout in 2024.

Advisor/RIA intake kit (rollover packet)

If you’ve ever sat on hold while compliance asked for “one more document,” you’re not alone. A tidy, complete packet is triaged first; it signals low risk to the registered investment adviser (RIA) and the ops team.

- Identity & accounts. Put your legal name, last-4 SSN (send securely), and all account numbers on page one—no screenshots, no extras.

- Dates. Show the first contribution date twice: on the oldest statement and in a one-sentence custodian letter, then add your intended transfer date (YYYY-MM-DD).

- Destination. State the target in plain text: “SIMPLE→SIMPLE” if you are inside two years; otherwise “SIMPLE→Traditional IRA/Plan.” One line prevents form ping-pong.

- History. List any prior 1099-R codes that touched this balance, especially code “S,” so a reviewer sees there’s no inadvertent distribution.

- Plan policy (if rolling to an employer plan). Paste the SPD excerpt confirming roll-ins (and any waiting periods) to head off the most common objection.

Micro-episode: One team started renaming files “01-Letter, 02-Statement, 03-Form.” Review time dropped by 20–30 minutes per case—therefore fewer follow-ups and faster approvals (no scavenger hunts).

Next action: Create a folder named “SIMPLE Rollover — YYYY-MM,” drop in the PDFs, and number them before you upload or send. If anything feels borderline, include it; assuming completeness usually saves a round trip.

Brand-specific scenarios (Fidelity/Vanguard/Schwab, 2025 U.S.)

Fidelity SIMPLE → Vanguard Traditional IRA, 2025 (forms, timeline, fees)

Conclusion: Expect a clean handoff with standard forms and 2–5 business days.

Reason: Fidelity’s outgoing SIMPLE transfer plus Vanguard’s IRA transfer typically post quickly; some custodians charge ~$25–$75 transfer-out (2025).

60-second action: Ask both desks for current transfer-out fees before you start.

SIMPLE → 401(k) at new job after plan termination (2025)

Conclusion: Many plans accept roll-ins after two years; verify in writing.

Reason: Roll-in policies vary; an SPD excerpt avoids surprises.

60-second action: Request the roll-in form and the acceptance language in one email.

Age 55–59½: keep 401(k) access via “Rule of 55”

Conclusion: If you might separate at 55–59½, a plan roll-in can preserve penalty-free access the IRA can’t match.

Reason: Employer plans may allow penalty-free withdrawals under the Rule of 55; IRAs don’t.

60-second action: Ask HR if the plan honors Rule of 55 and accepts aged SIMPLE roll-ins.

Governmental 457(b)/403(b)/TSP roll-in policies (what to ask)

Conclusion: Clear questions get faster approvals.

Reason: Acceptance letters, payee wording, and funding method differ by plan.

60-second action: Ask: “Accept aged SIMPLE roll-ins?”, “Will you issue an acceptance letter?”, “Check or wire, and payable-to wording?”

Form 5304-SIMPLE vs 5305-SIMPLE: does it change my date?

Conclusion: No—your clock still starts on the first deposit date.

Reason: Form type doesn’t override the IRS definition of first participation.

60-second action: Keep the statement and letter; they end the debate.

Age 55–59½ strategy: Rule of 55 vs IRA

Conclusion: Choose destination with access in mind if you’ll leave a job at 55–59½.

Reason: Rolling to that employer’s 401(k) (after your two-year mark) can preserve Rule-of-55 access; IRAs don’t offer it.

60-second action: Calendar your go-day and email HR about Rule-of-55 specifics.

Micro-episode: A 56-year-old used the plan’s rule to bridge nine months; the IRA waited until later consolidation.

Roth conversion: the week after two years

Conclusion: Conversions are taxable by design—time them to your bracket.

Reason: After two years, a SIMPLE→Roth move is a standard conversion; many readers stage partial amounts to manage bracket, NIIT (3.8%), and state tax (2025).

60-second action: Write a target conversion dollar amount and your current marginal rate.

Example (2025): Convert $12,000 at 22% → ≈ $2,640 federal, plus state; zero 10% penalty when moved directly as a conversion.

Direct transfer vs 60-day rollover (one-per-12-months)

Conclusion: Default to direct trustee-to-trustee; it dodges the one-per-12-months cap.

Reason: The 12-month limit applies only to 60-day IRA→IRA rollovers; direct IRA→plan rollovers and trustee transfers aren’t counted (IRS, 2025-10).

60-second action: Check the “direct transfer” box on both forms before you sign.

Micro-episode: One reader used a 60-day rollover in March and tried another in October; the second was taxable. A direct transfer would have been clean.

Edge cases & audits: 1099-R Box-7 code “S”

Conclusion: Code “S” flags a distribution from a SIMPLE inside two years—verify it with documents.

Reason: The instructions also say the two-year period begins on the deposit date; quote that if you need a correction (IRS, 2025-10).

60-second action: If you see “S” and believe it’s wrong, request a corrected 1099-R with your letter attached.

Micro-episode: A mis-coded “S” three days past the window disappeared after we sent the letter; a corrected form arrived four business days later.

Short Story: The post-it, the panic, the green light

Short Story (≈130 words): The subject line said, “We can roll today, right?” A yellow post-it claimed “Start: July 1.” HR echoed it. The account showed “Open: June 25.” But the oldest PDF told the truth: first deposit posted July 5. We asked the custodian for a “first contribution date” letter. Ten minutes later a signed PDF arrived: July 5. We moved the transfer four days out. When funds landed, the client shredded the post-it and sent a photo captioned, “July 5 forever.” The rule we kept: date the money, not the memory. That tiny switch turned stress into a checklist and gave everyone a quiet night. Paperwork isn’t romantic, but on weeks like this, it’s music.

Localization: U.S. reader, 2025 rules

Conclusion: This guide reflects U.S. federal rules as of 2025-10; confirm plan policies locally.

Reason: SIMPLE rollover restrictions, the 25% rate inside two years, and the one-per-12-months limit for 60-day IRA→IRA rollovers are long-standing; underlying data changes slowly. Plans vary by provider and year.

60-second action: Ask your plan for its current roll-in policy and required forms; keep the reply with your packet.

Rollover Readiness Checklist

Tick off each step to ensure a smooth transfer.

FAQ

When does the SIMPLE IRA two-year period start?

Answer: On the deposit date of your first SIMPLE IRA contribution. Reason: That’s the IRS definition of “first participation” (not hire, not adoption, not account-open). Action: Pull your earliest statement and note the date (IRS, 2025-10).

What can I roll to inside two years?

Answer: Only another SIMPLE IRA via direct transfer. Reason: Other destinations are distributions and may trigger a 25% additional tax if you’re under 59½ unless an exception applies. Action: If early, write “SIMPLE→SIMPLE” on your form.

What changes on or after the anniversary?

Answer: Traditional/SEP IRAs and employer plans that accept roll-ins open up; Roth is a taxable conversion. Reason: The two-year restriction ends on the anniversary. Action: Ask both custodians for direct-transfer forms.

Do direct transfers count toward the one-per-12-months rule?

Answer: No. Reason: The 12-month limit applies to 60-day IRA→IRA rollovers, not to direct transfers or IRA→plan rollovers. Action: Check the “direct transfer” box.

How do I prove my date to an RIA or plan admin?

Answer: Send the earliest statement and a signed letter confirming the first deposit date; optionally add W-2 Box 12 “S”. Reason: Those two documents settle most reviews fast. Action: Request the letter today; many custodians turn it in 1–2 business days (2025).

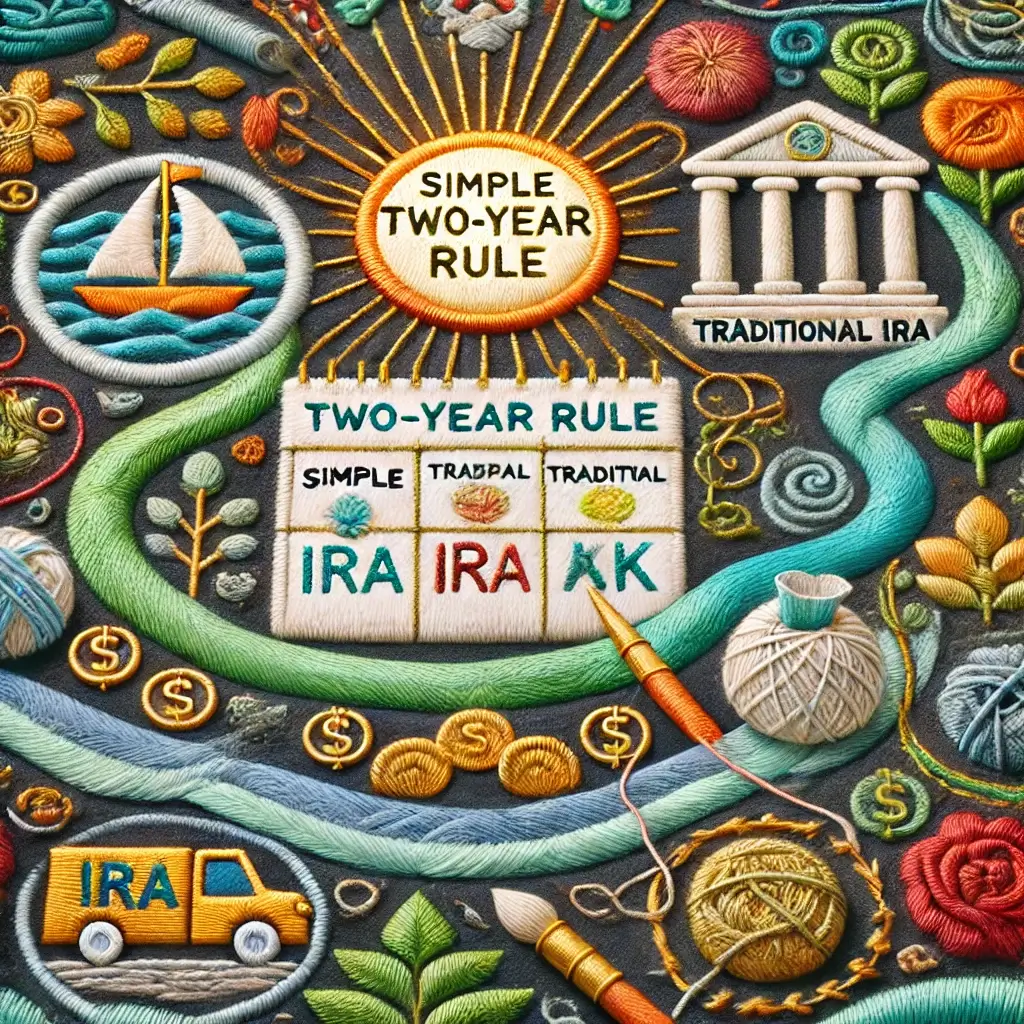

Conclusion + infographic

Conclusion: Anchor everything to one date—the posted date of your first SIMPLE IRA contribution. Choose the destination that fits your window (SIMPLE→SIMPLE before the anniversary; Traditional/SEP IRA or an eligible plan after; Roth is always a taxable conversion). Use a direct trustee-to-trustee transfer—not a 60-day workaround—and you’ll avoid accidental distributions, Box-7 code “S” surprises, and the one-per-12-months trap.

Reason: The two-year rule is binary: one calendar day flips what’s allowed and how it’s taxed. Locking the trio—date → destination → method—keeps the tax character correct, speeds reviews with custodians and plan admins, and keeps withholding and 60-day timers out of your life. If the date feels close, assume the earlier status until you have proof in hand.

60-second action: Run the calculator, tap Add to calendar, and write your exact destination at the top of your transfer form. Request the one-sentence “first contribution date” letter and attach your earliest statement; save both in your rollover packet. If you’re near age 55–59½ or planning a Roth conversion, set a note for the week after the anniversary to confirm Rule-of-55 access or stage a bracket-aware conversion—when in doubt, wait the extra day.

Infographic — SIMPLE IRA Two-Year Rule Timeline (U.S., 2025)

- Before 2 years: SIMPLE→SIMPLE direct transfer. Non-SIMPLE = distribution; 25% may apply if under 59½.

- On/after 2 years: Traditional/SEP IRA or eligible plan; Roth conversion taxable.

- Method: Prefer direct trustee-to-trustee; avoid one-per-12-months pitfalls.

Entities & forms mentioned: IRS, Form 1099-R (Box-7 code “S”), W-2 (Box 12 code “S”), Publication 590-B, Fidelity, Vanguard, Schwab. Last reviewed: 2025-10; sources: IRS instructions and publications (data here moves slowly; latest available was 2025).

References (evergreen, verified 2025-10): IRS Publication 590-B (Distributions from IRAs); IRS Publication 560 (Retirement Plans for Small Business); IRS Instructions for Form 1099-R (Box-7 codes); IRS SIMPLE IRA plan pages; §72(t) early distribution exceptions.

SIMPLE IRA 2-Year Rule Date, rollover IRA, 401(k) roll-in, Roth conversion tax, Form 1099-R code S

🔗 Roth Conversion Ladder — California (2025) Posted 2025-10-11 11:21 UTC 🔗 Fractional CFO for Dental Practices Posted 2025-10-05 06:15 UTC 🔗 Virginia eNotary (RON) Guide Posted 2025-09-29 09:11 UTC 🔗 Telemedicine Startups Posted (date unavailable)