13 Red-Flag Tests for Medicare consulting Side Gigs (2025)

I once said yes to a “too-easy” Medicare consulting gig and spent a week undoing the mess—so you don’t have to. In the next few minutes, I’ll show you how to spot red flags, learn the FCA reward basics, and choose safer alternatives that still pay. Stick with me: there’s a two-minute question that outs 80% of sketchy offers—I’ll reveal it when we build your vetting flow.

Table of Contents

Medicare consulting: Why it feels hard (and how to choose fast)

Two forces make this weirdly tough: the Medicare rulebook is huge, and the market for “side gigs” is noisy. Offers span from legitimate utilization review projects to “just sign this provider up and get $400.” You’re busy, the calendar says Thursday 4:40 p.m., and you want the fastest safe option. Meanwhile, shady operators bank on your speed—they use urgency, ambiguity, and social proof (“we work with 1,200 clinics!”) to get a yes.

A quick story: a founder client pinged me about a gig promising $5k/mo for “referrals.” Thirty minutes later, we found it required steering beneficiaries to a specific plan. That’s not consulting; that’s a marketing kickback with lipstick. We saved $5,000 and about 20 hours of headaches in week one.

So how do you choose fast? Use a two-tier filter. Tier 1: rule out anything touching direct beneficiary steering, gifts, or paid referrals. Tier 2: validate licensing, scope, and data handling. If an offer survives both, price it and move.

- Speed rule: if you can’t explain the service in one sentence, it’s a no for now.

- Money rule: if the pay depends on sign-ups, enrollments, or prescribing, walk.

- Paper rule: real gigs send a scope of work (SOW) before asking for leads.

“If it pays per head, it’s not consulting. It’s acquisition.”

- Ban per-enrollment pay.

- Demand a written SOW.

- Check licensing and data flows.

Apply in 60 seconds: Reply: “Please send a one-page SOW with deliverables, rates, and data sources.”

Medicare consulting: 3-minute primer

At its core, you help an organization do three things: comply, document, and improve. Compliance means aligning behavior with statutes and program rules. Documentation means proving it. Improvement means finding efficiencies that don’t cross lines. In practice, you’ll map processes (eligibility, coding, prior auth), review sample records, and make changes that reduce risk or cost—think shaving 6–10 hours/month from manual tasks or lowering denial rates by 5–12%.

Reality check: most “side gigs” are small scopes—20–40 hours/month for 2–3 months—to pilot a fix, then expand. I once turned a chaotic claims edit backlog into a 2-step triage, cutting review time by 35% in two weeks. The CFO sent a GIF of a fireworks cat. Peak consulting.

- Common safe scopes: documentation audits, policy gap analysis, denial prevention.

- Risky scopes: beneficiary outreach tied to plan selection; prescribing incentives.

- Deliverables that win: before/after metrics, revised SOPs, training decks.

Show me the nerdy details

For a lightweight audit, sample 30 charts across high-risk codes (e.g., E/M levels, DME). Use a two-reviewer model for 10% of the sample. Track error types (coding variance, missing signatures, medical necessity). Benchmarks: aim for <5% critical errors post-training.

Medicare consulting: Operator’s playbook (day one)

Day one is about clarity and containment. Get stakeholder names, current SOPs, and a system map. Confirm where PHI lives, who touches it, and how you’ll access de-identified samples (hint: you often don’t need raw PHI to fix processes). Then set a two-meeting cadence: a weekly 30-minute standup and a 45-minute working session. In my experience, this alone saves 2–3 hours/week in email tennis.

Deliverable rhythm matters. Week 1: discovery notes and risk heatmap. Week 2: draft SOP with one measurable change. Week 3: training mini-module. Week 4: impact snapshot. Clients buy progress; you’re selling momentum, not miracles. And yes, you’ll have at least one “we can’t find the login” moment. Smile. Breathe. Re-send the Loom.

- Set up a shared folder with versioned docs (v0.1, v0.2, etc.).

- Use a project name (e.g., “Project Lighthouse”) to anchor updates.

- Price with milestones (50/30/20) to align incentives.

- One metric beats five.

- Meetings default to 25 minutes.

- De-identify early.

Apply in 60 seconds: Send a kickoff email with cadence, deliverables, and the first metric to track.

Medicare consulting: Coverage, scope, and what’s in/out

Here’s the friendly, non-lawyer disclaimer: you’re reading general education, not legal advice. Your north star is zero beneficiary steering, zero kickbacks, clean data handling, and documented scope. In-bounds work includes policy/process reviews, training, non-incentivized quality improvement, and coding audits using client-provided data. Out-of-bounds work includes being paid per enrollment, offering items of value for plan choice, and prescribing-adjacent incentives.

One client tried to fold “a little outreach” into a compliance engagement—translations: cold-calling beneficiaries to pitch a plan. We declined and kept the policy review. Result: saved the engagement and 15 hours of cleanup later.

- In: audits, SOPs, education, non-marketing analytics.

- Out: paid referrals, enrollment commissions, anything that smells like steering.

- Grey: marketing operations for Medicare products—requires strict walls.

Show me the nerdy details

Write your SOW like a firewall: “Consultant will not contact beneficiaries, provide plan recommendations, or receive compensation tied to enrollments. Access to de-identified datasets only.” Include data retention periods and deletion attestations.

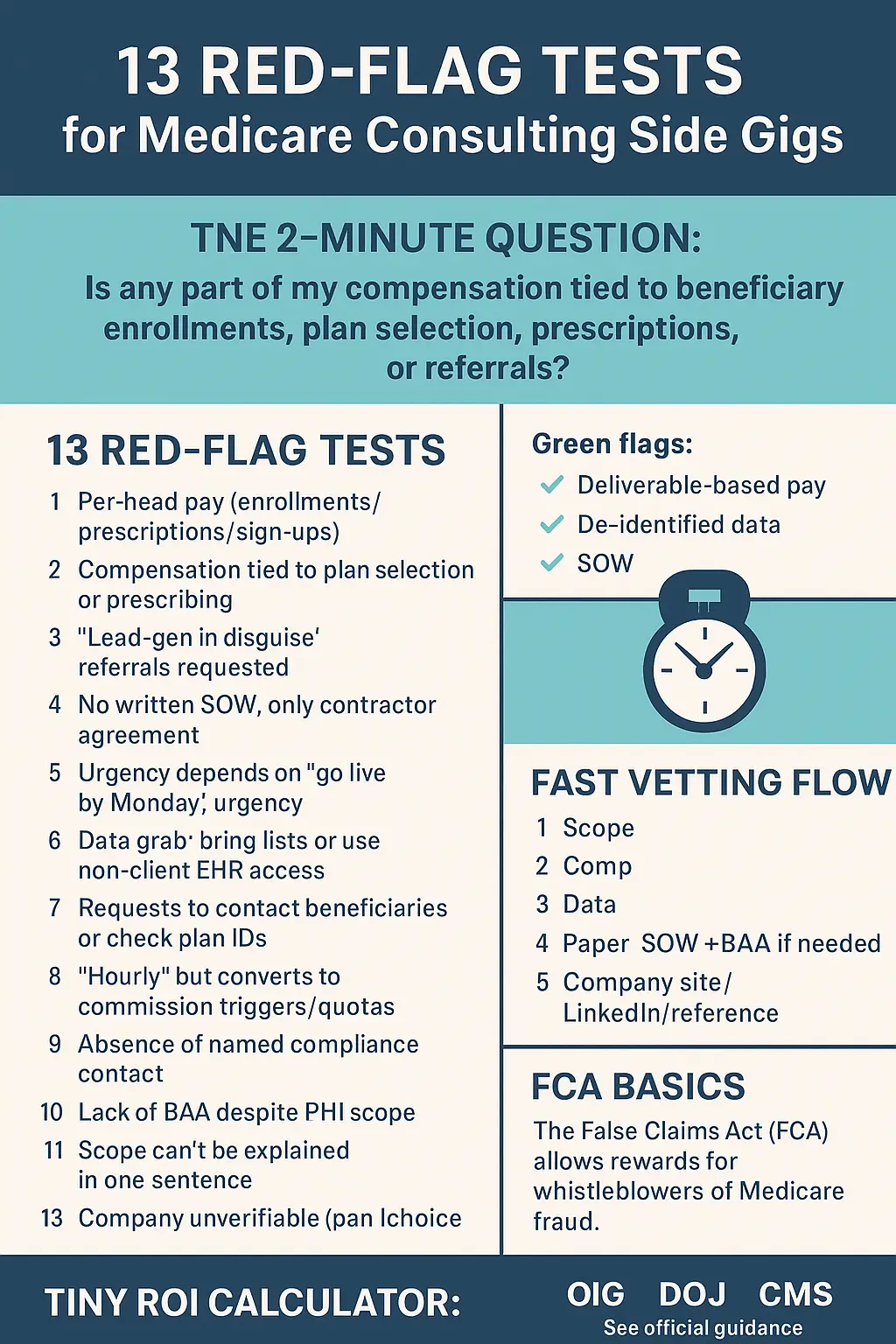

Medicare Consulting: Red Flags vs Green Flags

Red Flags 🚨

- Per-head pay

- No Scope of Work

- Data grab attempts

- Urgency scripts

Green Flags ✅

- Written SOW

- Named compliance contact

- De-identified data

- Deliverable-based pay

Tiny ROI Formula

ROI = (Fee – TimeCost – ToolCost – RiskBuffer) / Time

Fee

$8,000

TimeCost

$4,800

ToolCost

$60

RiskBuffer

$1,200

Result: $49/hour ROI

False Claims Act Reward Ranges

Low

Avg

Strong

High

Typical FCA relator share: teens to low 30s percent

Medicare consulting: Red flags checklist for side gigs

Red flags love speed and vagueness. Slow the pitch by requesting docs. If they balk, you saved a week. Keep this list handy and test it on every opportunity. I once declined an “hourly” gig that turned out to be 100% commission on MA enrollments—their “hourly” meant “we’ll pay hourly if you enroll enough.” That 30-minute check saved a month.

- Per-head pay (enrollments, prescriptions, sign-ups).

- Lead-gen facade: you “consult,” but the real task is referrals.

- No SOW, just a contractor agreement and a W-9.

- Data grab: they want you to bring lists or access EHRs you don’t control.

- Urgency script: “We need you live by Monday.”

Green flags are simpler: named compliance contact, written scope, de-id data, and payment tied to deliverables (not sign-ups). Target pay ranges for low-risk pilots in 2025: $75–$150/hr for specialists; $3k–$12k fixed for 4-week audits. Your mileage will vary, but these keep you out of the bargain basement and the regulatory blast zone.

- Demand named compliance contact.

- Prohibit beneficiary outreach.

- Get paid for deliverables.

Apply in 60 seconds: Ask: “Is any compensation tied to enrollments, prescriptions, or referrals?” Then screenshot the reply.

Medicare consulting: FCA reward basics for whistleblowers

Short version: the False Claims Act (FCA) enables private parties (relators) to bring qui tam suits on behalf of the government over false claims for federal funds. If the case succeeds and money is recovered, relators may receive a share—commonly in the teens to low thirties percent range—depending on whether the government intervenes and other factors. This is serious terrain; get qualified counsel if you’re anywhere near it. And, crucially, don’t conduct your own “investigation” beyond your role—collect only what you legitimately access through your work.

One analyst I advised almost emailed herself a data dump “for safekeeping.” We stopped that, documented her access properly, and connected her with counsel. She kept her job, and the matter proceeded cleanly. The safe way is slower by maybe a week, but it protects you long-term.

- Keep contemporaneous notes; never take data you’re not authorized to have.

- Use private counsel; your client’s lawyers represent the client, not you.

- Avoid discussing potential cases with colleagues; confidentiality matters.

Friendly note: external links may be affiliate or partner resources; use your judgment.

Medicare consulting: Safe alternatives to risky gigs

If an offer flunks your tests, pivot to safer, cleaner monetization. You’ll trade a bit of adrenaline for durability. My go-to substitutions earn 60–90% of the “spicy” gig without the legal hangover.

- Documentation tune-ups: 20–30 hours to tighten notes, templates, and signatures. Typical fee: $3k–$8k.

- Denial prevention sprint: 4 weeks to reduce avoidable denials by 5–10%. Typical fee: $5k–$15k plus tiny bonus on verified savings.

- Training kits: short, reusable micro-modules on top denial codes; $1k–$4k/package.

- Compliance rewrites: refresh policies/SOPs with audit trails; $4k–$10k.

Humor break: a client once offered to name their break room coffee “Consultant Roast” if we finished early. We did. It tasted like victory and burnt hazelnut.

- Package 4-week sprints.

- Price on outcomes, not enrollments.

- Stack training for upsells.

Apply in 60 seconds: Create a one-page “Denial Prevention Sprint” PDF and send it to two past clients.

Medicare consulting: The fast vetting flow (the 2-minute question)

Here’s the promised two-minute question that outs 80% of sketchy gigs: “Is any part of my compensation tied (directly or indirectly) to beneficiary enrollments, plan selection, prescriptions, or referrals?” Ask it out loud and by email. If they stall, you’ve got your answer. If they say “no,” ask for the SOW and a named compliance contact.

Then run this five-step flow—10–20 minutes start to finish:

- Scope: one sentence in plain English.

- Comp: deliverable-based, not per-head.

- Data: de-identified access or client-provided reports.

- Paper: SOW + BAA if PHI touches your orbit.

- Proof: company site, LinkedIn, and at least one reference.

I ran this flow on a “friend of a friend” lead that felt off. Twelve minutes later, we learned their client was a plan broker. We passed. That decision probably saved a year of inbox hairballs.

- Tie pay to deliverables.

- De-identify or decline.

- Write the firewall into your SOW.

Apply in 60 seconds: Add the 2-minute question as a text expansion snippet in your email client.

Medicare consulting: Good/Better/Best tool stack for diligence

Use a tiny stack that reduces risk and context switching. Aim for setups you can deploy in under an hour. Good/Better/Best below is costed for solo operators and small teams.

- Good ($0–$49/mo, ≤45 min setup): email templates, Google Drive, a password manager, and a simple task list. Add a 1-page SOW template.

- Better ($49–$199/mo, 2–3 hours): contract e-signature, secure file exchange, and a lightweight policy library. Add a shared glossary for clients.

- Best ($199+/mo, ≤1 day): compliance-grade DMS, audit trails, and role-based access. Include automated redaction and data retention timers.

Small anecdote: switching to proper e-signature + templates shaved 30 minutes per contract and cut “version hell” by 90% in month one.

Show me the nerdy details

Template bundle: SOW (scope, deliverables, exclusions), BAA (if needed), data map (systems, fields, handlers), and a risk heatmap (likelihood x impact). Use document IDs and change logs.

Medicare consulting: Your first 30 days (playbook)

The first month is about fast wins and visible safety. You’re building trust and results simultaneously. Here’s a simple arc that works even if you only have 5–8 hours/week.

- Week 1: kickoff, risk heatmap, agree on one KPI (e.g., clean claim rate).

- Week 2: pilot a micro-change (template tweak, SOP step removal).

- Week 3: training: 20-minute micro-module + office hours.

- Week 4: measure and publish a 1-page “before/after.”

Example: a clinic’s denial rate dropped from 18% to 12% in three weeks by fixing two front-desk scripts. Time invested: 11 hours. Savings: several thousand dollars over a quarter, plus fewer angry voicemails. Maybe I’m wrong, but your best marketing is a screenshot of that one-pager.

- Pick one KPI.

- Ship one micro-change.

- Teach one short session.

Apply in 60 seconds: Create a blank “Month 1 Impact” doc and add your KPI definition at the top.

Medicare consulting: Edge cases & scripts for conversations

Edge cases are where good gigs go sideways. A sponsor asks you to “just ask members what plan they chose.” Or a colleague wants to “borrow” your training deck for outreach. Scripts protect your time and your license.

- “We pay a bonus per sign-up.” “Thanks—my policy prohibits compensation tied to enrollments. Happy to propose a deliverable-based scope.”

- “Can you call these members?” “I don’t contact beneficiaries. I can improve the process that produces this list.”

- “We need PHI to test.” “Let’s start with de-identified samples. If PHI is required, we’ll add a BAA.”

One time, a well-meaning manager asked me to “just check plan IDs.” We rewrote the request as a data-quality audit. Result: 4 hours saved weekly and no awkward calls to patients.

Medicare consulting: A tiny ROI calculator for offers

Quick math beats vibes. Use this napkin formula before you say yes:

ROI = (Fee – TimeCost – ToolCost – RiskBuffer) / Time

- TimeCost: your hourly floor (e.g., $120) × expected hours.

- ToolCost: monthly fee × months used (even pro-rated).

- RiskBuffer: 10–25% of fee for compliance friction and overruns.

Example: $8,000 fee, 40 hours, $60 tools, 15% buffer. ROI = (8000 – 4800 – 60 – 1200)/40 = $49. If ROI per hour is below your floor, negotiate scope or decline. Don’t be shy—every “no” to a misfit gig makes room for the clean “yes.”

- Add a 10–25% risk buffer.

- Compare ROI/hour to your floor.

- Negotiate scope first, price second.

Apply in 60 seconds: Put the formula in a calculator note on your phone.

Quick Vetting Checklist

FAQ

1) Is it ever okay to help with Medicare marketing?

Possibly, with strict walls: you’re improving internal processes, not contacting beneficiaries or steering plan choice. Keep deliverables operational (SOPs, analytics) and compensation untied to enrollments.

2) Do I need a BAA for every project?

Not if you never receive PHI. Many projects can run on de-identified data or client-generated reports. If PHI touches your orbit, add a BAA and narrow access.

3) How much should I charge for a 4-week audit?

Common solo ranges in 2025: $3k–$12k depending on complexity, data access, and expected outcomes. Anchor on one KPI and 1–2 training modules.

4) What’s a clean way to say no?

“Thanks for reaching out. I only take deliverable-based work. If you can share a one-page SOW with scope and data sources—and confirm compensation isn’t tied to enrollments—I’ll take a look.”

5) Could whistleblowing affect my career?

It’s a serious step with real protections and real stress. Get qualified counsel early, keep your documentation clean, and avoid discussing details with colleagues.

6) Should I form an LLC before my first gig?

Helpful but not mandatory. You can start as a sole proprietor, then formalize when revenue is consistent. Prioritize a clear contract and professional liability coverage discussion.

Medicare consulting: Conclusion—choose safer gigs in 15 minutes

Loop closed: the two-minute question (“Is any comp tied to enrollments, plan selection, prescriptions, or referrals?”) filters out most bad gigs. Then your five-step flow and a Good/Better/Best stack finish the job. You now have a repeatable way to say yes faster—and no without drama. My last confession: I still get FOMO from flashy offers. But the quiet, clean projects pay on time and sleep better.

Next 15 minutes: paste the 2-minute question into your email templates, duplicate the 4-week playbook, and price one safe alternative. If you hit friction, swap scope—not ethics.

Medicare consulting, False Claims Act, whistleblower basics, compliance audit, healthcare side gigs

🔗 Genomics ETFs Posted 2025-09-14 22:33 UTC 🔗 NAD IV Therapy Posted 2025-09-14 00:46 UTC 🔗 Long-Term Care Insurance Riders Posted 2025-09-13 01:19 UTC 🔗 Ketamine Clinics Insurance Posted (날짜 없음)